Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 6.01%

- Poor long term growth as Net Sales has grown by an annual rate of 10.26% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.91 times

Flat results in Sep 25

Falling Participation by Institutional Investors

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Dyes And Pigments

INR 668 Cr (Micro Cap)

19.00

34

0.00%

0.75

3.24%

0.60

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-22-2023

Risk Adjusted Returns v/s

Returns Beta

News

Bodal Chemicals Sees Revision in Market Evaluation Amidst Challenging Fundamentals

Bodal Chemicals, a microcap player in the Dyes and Pigments sector, has experienced a revision in its market evaluation reflecting a more cautious analytical perspective. This shift is driven by a combination of fundamental and technical factors that have influenced the company’s overall assessment in recent months.

Read More

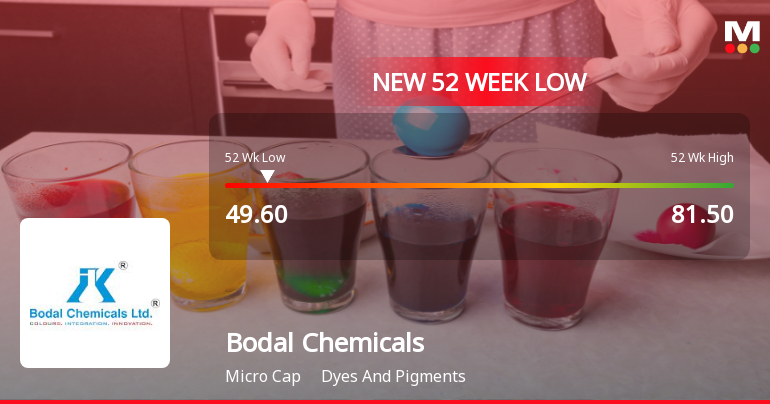

Bodal Chemicals Stock Falls to 52-Week Low of Rs.49.6 Amidst Prolonged Downtrend

Bodal Chemicals has reached a new 52-week low of Rs.49.6, marking a significant point in the stock’s ongoing downward trajectory. Despite a slight rebound today, the stock remains below all key moving averages, reflecting persistent pressures within the dyes and pigments sector.

Read More

Bodal Chemicals Sees Revision in Market Evaluation Amidst Challenging Fundamentals

Bodal Chemicals has experienced a revision in its market evaluation, reflecting shifts in its fundamental and technical outlook. The changes stem from a combination of factors including financial trends, valuation considerations, and technical indicators, all of which contribute to the evolving perspective on this microcap player in the Dyes and Pigments sector.

Read More Announcements

Announcement under Regulation 30 (LODR)-Credit Rating

09-Dec-2025 | Source : BSEBodal Chemicals Limited herewith inform Exchange about credit rating

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Nov-2025 | Source : BSEBodal Chemicals Limited herewith submit copies of Newspaper publications

Board Meeting Outcome for Outcome Of Board Meeting

12-Nov-2025 | Source : BSEBodal Chemicals Limited herewith submit outcome of Board Meeting

Corporate Actions

No Upcoming Board Meetings

Bodal Chemicals Ltd has declared 5% dividend, ex-date: 22 Sep 23

Bodal Chemicals Ltd has announced 2:10 stock split, ex-date: 10 Jun 10

No Bonus history available

Bodal Chemicals Ltd has announced 1:2 rights issue, ex-date: 04 Mar 08

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 15 FIIs (0.29%)

Sureshbhai Jayantibhai Patel (29.47%)

Ashokkumar Giriraj Bansal (1.48%)

35.93%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.78% vs 0.74% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -37.15% vs -34.28% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.88% vs 28.40% in Sep 2024

Growth in half year ended Sep 2025 is 1,193.66% vs -141.16% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 29.27% vs -15.50% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -9.71% vs -87.43% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 25.12% vs -11.41% in Mar 2024

YoY Growth in year ended Mar 2025 is 185.94% vs -82.99% in Mar 2024