Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 4.78%

- Poor long term growth as Operating profit has grown by an annual rate 19.04% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.03

Positive results in Sep 25

With ROE of 16.7, it has a Very Expensive valuation with a 17.7 Price to Book Value

Majority shareholders : Non Institution

Market Beating performance in long term as well as near term

Total Returns (Price + Dividend)

Swadeshi Inds for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Swadeshi Industries & Leasing Ltd is Rated Hold

Swadeshi Industries & Leasing Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 12 August 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and technical outlook.

Read More

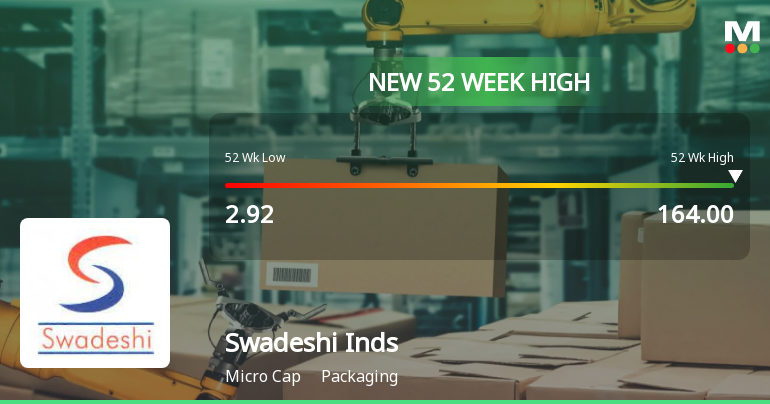

Swadeshi Industries & Leasing Hits New 52-Week High at Rs.164

Swadeshi Industries & Leasing has reached a significant milestone by touching a new 52-week high of Rs.164, marking a notable moment in the stock's recent performance and reflecting sustained momentum in the packaging sector.

Read More

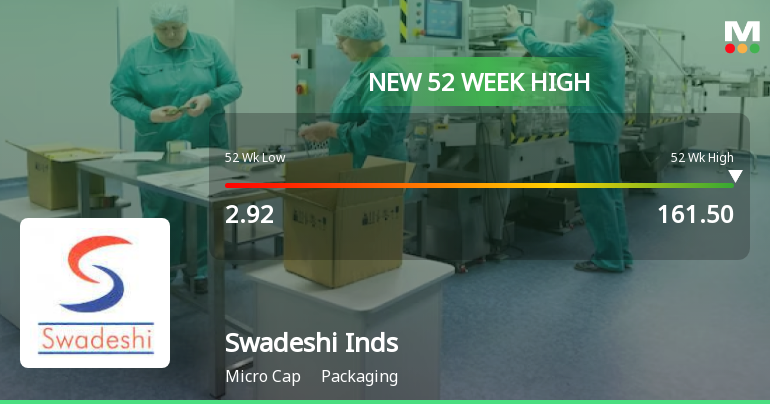

Swadeshi Industries & Leasing Hits New 52-Week High at Rs.161.5

Swadeshi Industries & Leasing, a key player in the packaging sector, has reached a significant milestone by touching a new 52-week high of Rs.161.5. This achievement marks a notable phase of sustained momentum for the stock, reflecting a strong performance over the past several weeks.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Nov-2025 | Source : BSENewspaper Advertisement for Financial Results for the quarter and half year ended September 30 2025

Resuts - Financial Results For September 30 2025

14-Nov-2025 | Source : BSEFinancial results for quarter and half year ended September 30 2025

Board Meeting Outcome for Quarterly Unaudited Standalone Financial Statement For The Quarter And Half Year Ended September 30 2025

14-Nov-2025 | Source : BSEBoard meeting outcome for Quarterly unaudited standalone financial statement for the quarter and half year ended September 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Swadeshi Industries & Leasing Ltd has announced 10:1 stock split, ex-date: 14 Jun 18

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Jayshree Radheshyam Sharma (34.97%)

Fresh Trexim Pvt Ltd (4.66%)

32.47%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 10.01% vs 40.12% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -45.71% vs -12.50% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 190.76% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 0.00% vs -100.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 0.00% vs 100.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 2,000.00% vs 137.50% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 546.34% vs 236.99% in Mar 2024

YoY Growth in year ended Mar 2025 is 1,816.67% vs 40.00% in Mar 2024