Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 12.84 times

- The company has been able to generate a Return on Equity (avg) of 0.48% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

72.38% of Promoter Shares are Pledged

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Realty

INR 55 Cr (Micro Cap)

NA (Loss Making)

40

0.00%

-0.55

19.69%

-0.07

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-15-2011

Risk Adjusted Returns v/s

Returns Beta

News

Ansal Properties & Infrastructure Hits Lower Circuit Amid Heavy Selling Pressure

Ansal Properties & Infrastructure Ltd witnessed a sharp decline on 26 Dec 2025, hitting its lower circuit price limit as intense selling pressure gripped the stock. The realty sector company’s shares closed at ₹3.46, marking the maximum daily loss and reflecting a continuation of recent negative momentum amid subdued investor participation and unfilled supply on the trading floor.

Read More

Ansal Properties & Infrastructure Ltd is Rated Strong Sell

Ansal Properties & Infrastructure Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 25 August 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are based on the company’s current position as of 25 December 2025, providing investors with the latest comprehensive analysis.

Read More

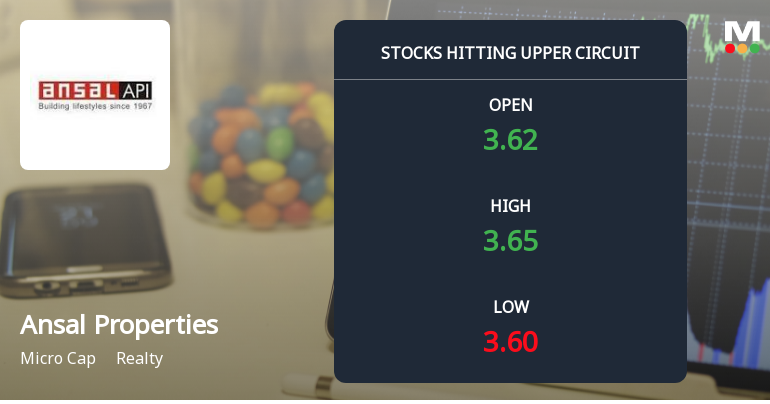

Ansal Properties & Infrastructure Hits Upper Circuit Amid Strong Buying Pressure

Ansal Properties & Infrastructure Ltd witnessed a significant trading session on 24 Dec 2025, hitting its upper circuit price limit of ₹3.64, reflecting robust buying interest and a maximum daily gain of 1.96%. This surge outpaced the Realty sector’s 0.48% and the Sensex’s 0.18% returns, signalling renewed investor focus on the micro-cap realty player despite subdued liquidity and falling delivery volumes.

Read More Announcements

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

24-Dec-2025 | Source : BSEThe Company has informed the stock exchange about the 06th meeting of the committee of creditors of the Company scheduled to be held on the 30th December 2025.

Corporate Insolvency Resolution Process (CIRP)-Updates - Corporate Insolvency Resolution Process (CIRP)

23-Dec-2025 | Source : BSEThe Company has informed the stock exchanges about the Minutes of 46th Meeting of the Committee of Creditors of Fernhill Project of Ansal Properties and Infrastructure Limited situated at District Gurgaon Haryana held on the 21st December 2025.

Corporate Insolvency Resolution Process (CIRP)-Outcome of meeting of Committee of Creditors

22-Dec-2025 | Source : BSEThe Company has informed the stock exchanges about the outcome/ Voting results of the 45th Meeting of Committee of Creditors (CoC) of Fernhill Project of Ansal Properties and Infrastructure Limited (the Company) situated at Gurugram Haryana held on 15th December 2025 (Voting result end date: 21st December 2025).

Corporate Actions

No Upcoming Board Meetings

Ansal Properties & Infrastructure Ltd has declared 10% dividend, ex-date: 15 Sep 11

Ansal Properties & Infrastructure Ltd has announced 5:10 stock split, ex-date: 10 May 06

Ansal Properties & Infrastructure Ltd has announced 1:1 bonus issue, ex-date: 23 Apr 07

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

72.3797

Held by 2 Schemes (0.0%)

Held by 1 FIIs (0.25%)

Sushil Ansal (16.87%)

Ashok Kumar Gupta (1.91%)

37.45%

Quarterly Results Snapshot (Standalone) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -91.82% vs -26.29% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is 100.92% vs -11,155.59% in Mar 2025

Half Yearly Results Snapshot (Consolidated) - Sep'24

Growth in half year ended Sep 2024 is 26.87% vs -29.09% in Sep 2023

Growth in half year ended Sep 2024 is -646.77% vs -890.43% in Sep 2023

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 41.72% vs -13.94% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -885.85% vs 88.13% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 34.97% vs -24.37% in Mar 2024

YoY Growth in year ended Mar 2025 is -33,216.46% vs 101.29% in Mar 2024