Stock DNA

Holding Company

INR 24,591 Cr (Small Cap)

197.00

23

0.00%

0.00

0.37%

0.71

Total Returns (Price + Dividend)

JSW Holdings for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

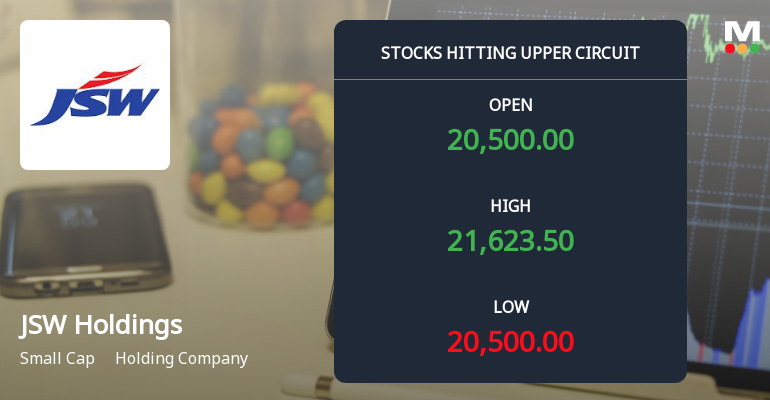

JSW Holdings Hits Upper Circuit Amid Strong Buying Pressure and Market Optimism

JSW Holdings Ltd witnessed robust buying interest on 11 Dec 2025, hitting its upper circuit limit with a maximum daily gain of 4.86%, reflecting heightened investor enthusiasm and a surge in demand that led to a regulatory trading freeze for the day.

Read More

JSW Holdings Technical Momentum Shifts Amid Mixed Indicator Signals

JSW Holdings has exhibited a notable shift in its technical momentum, transitioning from a sideways trend to a mildly bullish stance on weekly charts. This development comes amid a complex interplay of technical indicators, including MACD, RSI, moving averages, and Bollinger Bands, which collectively paint a nuanced picture of the stock’s near-term trajectory.

Read More

JSW Holdings Technical Momentum Shifts Amid Mixed Market Signals

JSW Holdings has experienced a notable shift in its technical momentum, reflecting a complex interplay of market forces and indicator signals. Recent evaluation adjustments reveal a transition from a mildly bullish trend to a sideways movement, underscoring a period of consolidation for the holding company’s stock.

Read More Announcements

Disclosure Regarding ESG Rating Under Regulation 30 Of SEBI (Listing Obligation And Disclosure Requirements) Regulations 2015

26-Nov-2025 | Source : BSEDisclosure regarding ESG Ratings of the JSW Holdings Private Limited

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Nov-2025 | Source : BSEPlease find enclose herewith the copies of newspaper publication containing an extract of financial results in published in Financial express (English) and Mumbai Lakshadeep(Regional)

Financial Results Of The Company For The Second Quarter And Half Year Ended September 30 2025

06-Nov-2025 | Source : BSEThe Board of Directors of the Company at its meeting held today i.e November 06 2025 approved unaudited Financial results for the quarter ended September 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 25 Schemes (0.2%)

Held by 94 FIIs (22.64%)

Siddeshwari Tradex Private Limited (11.34%)

Sparrow Asia Diversified Opportunities Fund (3.71%)

6.15%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 177.92% vs 2.07% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 98.67% vs 247.84% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -40.00% vs 64.30% in Sep 2024

Growth in half year ended Sep 2025 is -41.37% vs 96.69% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 53.35% vs -62.71% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 52.21% vs -57.84% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 46.31% vs -58.31% in Mar 2024

YoY Growth in year ended Mar 2025 is 25.89% vs -53.07% in Mar 2024