Stock DNA

Housing Finance Company

INR 41 Cr (Micro Cap)

NA (Loss Making)

13

0.00%

0.00

-2.92%

8.50

Total Returns (Price + Dividend)

Ruparel Food for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

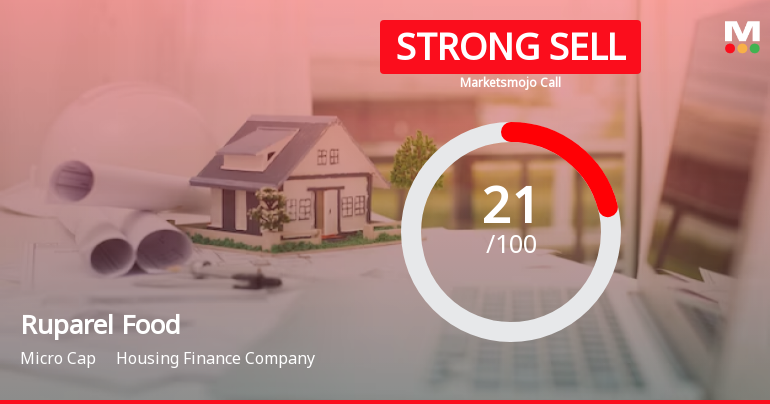

Ruparel Food Products Ltd is Rated Strong Sell

Ruparel Food Products Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 23 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read More

Ruparel Food Products Hits 52-Week Low at Rs.119.15 Amid Market Pressure

Ruparel Food Products has reached a new 52-week low of Rs.119.15, marking a significant price level for the stock within the Housing Finance Company sector. This decline comes amid broader market fluctuations and sector-specific dynamics, with the stock trading below all key moving averages.

Read More

Ruparel Food's Market Assessment Revised Amidst Challenging Financial Trends

Ruparel Food, a microcap player in the housing finance sector, has experienced a revision in its market evaluation reflecting ongoing operational challenges and valuation concerns. The recent shift in analytical perspective highlights key aspects of the company’s financial and technical profile, offering investors a clearer understanding of its current standing.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Nov-2025 | Source : BSENewspaper publication for abridged un-audited (standalone & consolidated) financial results for quarter and half year ended September 30 2025

Board Meeting Outcome for Board Meeting Outcome For Approval Of Un-Audited Financial Results (Standalone And Consolidated) For Quarter And Half Year Ended September 30 2025

14-Nov-2025 | Source : BSEAttached herewith is the Outcome of Board Meeting for Approval Of Un-Audited Financial Results (Standalone And Consolidated) For Quarter and half year ended September 30 2025

Un-Audited Financial Results For September 30 2025

14-Nov-2025 | Source : BSEUn-Audited (Standalone and Consolidated) Financial Results for September 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ruparel Pankajkumar Ranchhoddas Huf (18.15%)

Bhavna Darshan Mehta (2.12%)

26.65%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 0.00% vs -100.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 87.50% vs -900.00% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 14.22% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 11.11% vs 10.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 0.00% vs 0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 0.00% vs 6.67% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 30.00% vs -5.26% in Mar 2024