Dashboard

Poor long term growth as Operating profit has grown by an annual rate -4.80% of over the last 5 years

Flat results in Sep 25

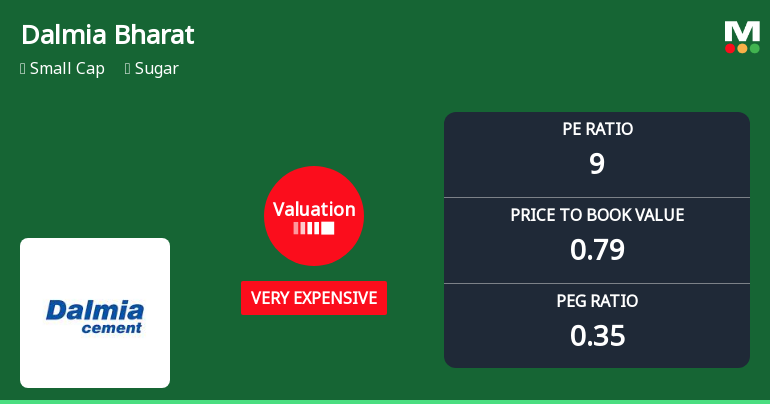

With ROE of 9, it has a Expensive valuation with a 0.8 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0.01% of the company

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Jun-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

Dalmia Bharat’s Evaluation Metrics Revised Amidst Sector Challenges and Market Underperformance

Dalmia Bharat’s recent assessment has undergone a revision reflecting shifts in its fundamental and technical outlook. The changes stem from a combination of valuation concerns, subdued financial trends, and bearish technical indicators, set against a backdrop of persistent underperformance within the sugar sector and the broader market.

Read More

Dalmia Bharat Sugar & Industries: Valuation Shifts and Market Position Analysis

Dalmia Bharat Sugar & Industries has experienced notable changes in its valuation parameters, reflecting a shift in market assessment. This article examines the company’s current price-to-earnings (P/E) ratio, price-to-book value (P/BV), and other key financial metrics in comparison to historical data and peer averages within the sugar industry.

Read More

Dalmia Bharat Sugar & Industries: Valuation Shifts and Market Position Analysis

Dalmia Bharat Sugar & Industries has experienced a notable revision in its valuation parameters, reflecting a shift in market assessment within the sugar sector. This article examines the recent changes in key financial metrics such as price-to-earnings (P/E) and price-to-book value (P/BV) ratios, comparing them with historical data and peer averages to provide a comprehensive view of the stock’s price attractiveness.

Read More Announcements

Closure of Trading Window

24-Dec-2025 | Source : BSEClosure of Trading Window

Apportionment Of Cost Of Acquisition Of Equity Shares Of Dalmia Bharat Sugar And Industries Limited And Dalmia Bharat Refractories Limited.

18-Dec-2025 | Source : BSEApportionment of cost of acquisition of Equity Shares of Dalmia Bharat Sugar and Industries Limited and Dalmia Bharat Refractories Limited.

Announcement under Regulation 30 (LODR)-Credit Rating

12-Dec-2025 | Source : BSERating letter dated December 12 2025 of ICRA Limited.

Corporate Actions

No Upcoming Board Meetings

Dalmia Bharat Sugar & Industries Ltd has declared 75% dividend, ex-date: 30 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.0%)

Held by 54 FIIs (0.97%)

Samagama Holdings And Commercial Private Limited (44.32%)

Anil Kumar Goel (5.23%)

20.33%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.08% vs -7.56% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -40.59% vs -80.98% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 3.09% vs 19.54% in Sep 2024

Growth in half year ended Sep 2025 is -41.75% vs -7.58% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 26.92% vs -0.60% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -0.40% vs -24.56% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 28.47% vs -10.85% in Mar 2024

YoY Growth in year ended Mar 2025 is 34.14% vs 8.96% in Mar 2024