Dashboard

Weak Long Term Fundamental Strength with a -6.10% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 6.85 times

- The company has been able to generate a Return on Equity (avg) of 0.72% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

With ROCE of 0.9, it has a Very Expensive valuation with a 4.8 Enterprise value to Capital Employed

Total Returns (Price + Dividend)

Norben Tea for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

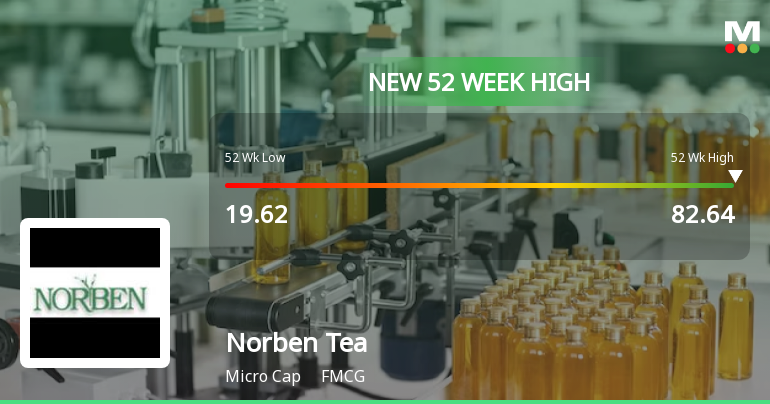

Norben Tea & Exports Hits New 52-Week High at Rs.82.64

Norben Tea & Exports has reached a significant milestone by touching a new 52-week high of Rs.82.64, marking a notable moment in the stock's recent performance within the FMCG sector.

Read More

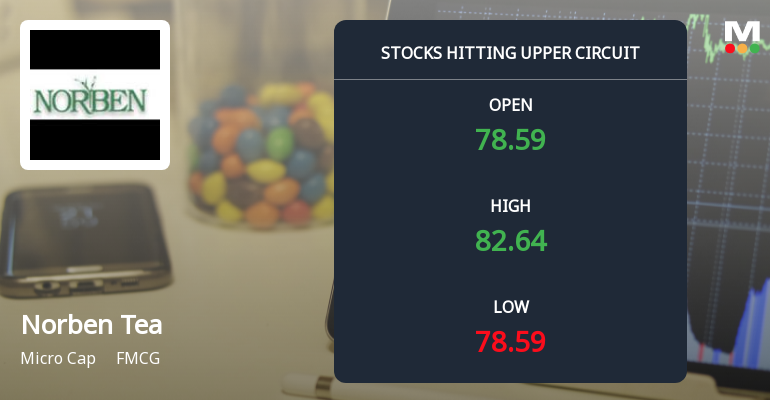

Norben Tea & Exports Hits Upper Circuit Amid Strong Buying Pressure

Norben Tea & Exports Ltd witnessed robust market activity on 26 Dec 2025, hitting its upper circuit price limit of Rs 82.51, marking a new 52-week and all-time high. The stock outperformed its FMCG sector peers and broader market indices, reflecting strong investor demand and a notable surge in buying interest.

Read More

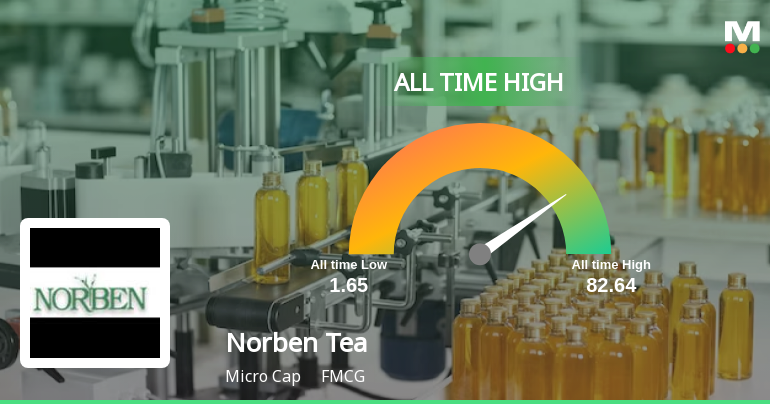

Norben Tea & Exports Hits All-Time High Amidst Strong Market Performance

Norben Tea & Exports has reached a significant milestone by hitting its all-time high, reflecting a remarkable trajectory in the FMCG sector. The stock’s recent performance underscores its resilience and strong market presence, marking a pivotal moment for the company and its stakeholders.

Read More Announcements

Announcement under Regulation 30 (LODR)-Cessation

23-Dec-2025 | Source : BSECompany Secretary and Compliance officer of the Company has been released from his duties from closure of business hour on 23rd December 2025.

Appointment of Company Secretary and Compliance Officer

18-Dec-2025 | Source : BSEThe Company has appointed Ms. Namrata Das as the Company Secretary and Compliance Officer of the Company w.e.f 24.12.2025

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

11-Dec-2025 | Source : BSECompany Secretary of the Company has tendered his resignation letter dated 11.12.2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 3 Schemes (0.09%)

Held by 0 FIIs

Tongani Tea Company Ltd. (14.54%)

Kailash Dhanuka Huf (4.99%)

49.9%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 94.31% vs 13.89% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -62.07% vs 128.16% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -20.44% vs 14.04% in Sep 2024

Growth in half year ended Sep 2025 is -60.00% vs 25.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 21.89% vs -23.33% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 226.87% vs -197.10% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 16.26% vs -15.42% in Mar 2024

YoY Growth in year ended Mar 2025 is 89.41% vs -909.52% in Mar 2024