Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -0.70% and Operating profit at -195.86% over the last 5 years

Negative results in Sep 25

Risky - Negative Operating Profits

Falling Participation by Institutional Investors

Stock DNA

Cables - Electricals

INR 1,373 Cr (Small Cap)

NA (Loss Making)

62

0.00%

-0.18

-7.29%

5.09

Total Returns (Price + Dividend)

Quadrant Future for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

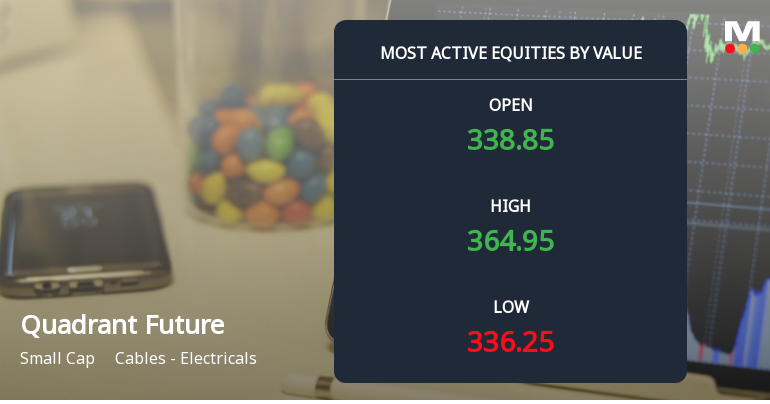

Quadrant Future Tek Sees High Value Trading Amid Mixed Market Signals

Quadrant Future Tek Ltd, a key player in the Cables - Electricals sector, has emerged as one of the most actively traded stocks by value on 24 December 2025, reflecting significant investor interest despite a day marked by price volatility and sector underperformance.

Read More

Quadrant Future Tek Sees High-Value Trading Amid Volatile Market Activity

Quadrant Future Tek Ltd, a key player in the Cables - Electricals sector, has emerged as one of the most actively traded stocks by value in recent sessions. The stock’s trading volumes and value turnover have drawn significant attention from market participants, reflecting heightened investor interest and notable volatility within the segment.

Read More

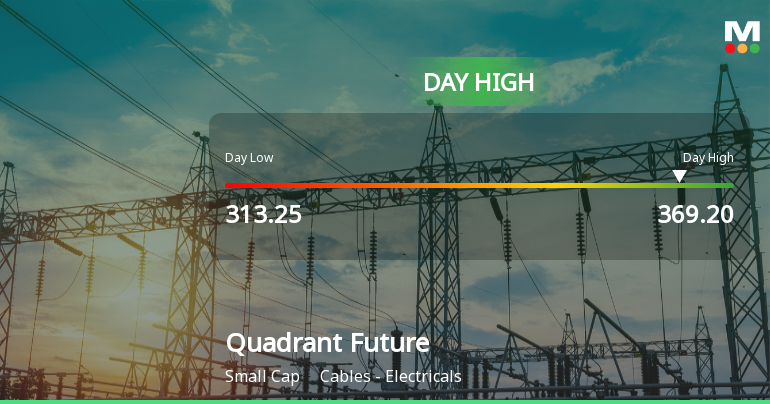

Quadrant Future Tek Hits Intraday High with Strong Trading Momentum

Quadrant Future Tek recorded a robust intraday performance today, reaching a high of Rs 363, reflecting a 7.52% rise within the trading session. The stock outpaced its sector and broader market indices, demonstrating notable volatility and sustained upward movement over recent days.

Read More Announcements

Clarification sought from Quadrant Future Tek Ltd

24-Dec-2025 | Source : BSEThe Exchange has sought clarification from Quadrant Future Tek Ltd on December 24 2025 with reference to significant movement in price in order to ensure that investors have latest relevant information about the company and to inform the market so that the interest of the investors is safeguarded.

The reply is awaited.

Announcement under Regulation 30 (LODR)-Change in Management

29-Nov-2025 | Source : BSEIntimation for cessation of Chief Executive Officer of the Company w.e.f 29th November 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Nov-2025 | Source : BSEIntimation for newspaper Publication of Unaudited financial results for the quarter and half year ended Sep 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 3 Schemes (3.16%)

Held by 7 FIIs (1.56%)

Rupinder Singh (13.5%)

Kotak Mahindra Trustee Co Ltd A/c Kotak Manufacture In India Fund (2.19%)

16.26%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 19.74% vs -50.86% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -17.70% vs -954.43% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -3.09% vs 5.85% in Sep 2024

Growth in half year ended Sep 2025 is -142.81% vs -181.26% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -0.76% vs -0.68% in Mar 2024

YoY Growth in year ended Mar 2025 is -269.36% vs -16.40% in Mar 2024