Dashboard

Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.14

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.14

- The company has been able to generate a Return on Equity (avg) of 7.90% signifying low profitability per unit of shareholders funds

The company has declared Negative results for the last 3 consecutive quarters

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Leisure Services

INR 8,115 Cr (Small Cap)

2,617.00

53

0.00%

0.90

0.22%

5.82

Total Returns (Price + Dividend)

Sapphire Foods for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sapphire Foods India Ltd is Rated Strong Sell

Sapphire Foods India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 Dec 2025. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the company’s current position as of 25 December 2025, providing investors with an up-to-date perspective on the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read More

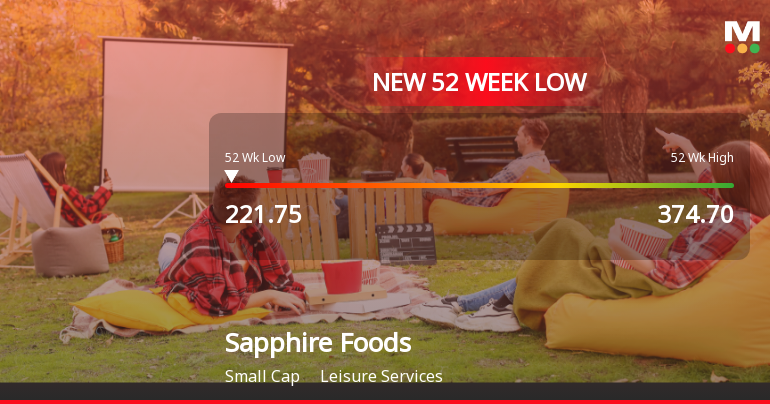

Sapphire Foods India Stock Falls to 52-Week Low of Rs.221.75

Sapphire Foods India has reached a new 52-week low, with its stock price touching Rs.221.75 today. This marks a significant decline amid a series of quarterly results showing subdued profitability and persistent challenges in financial metrics, contrasting with broader market trends.

Read More

Sapphire Foods India Falls to 52-Week Low of Rs.221.95 Amid Continued Downtrend

Sapphire Foods India has reached a new 52-week low of Rs.221.95, marking a significant decline in its share price amid a sustained downward trend over recent sessions. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures within the leisure services industry.

Read More Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

05-Dec-2025 | Source : BSESapphire Foods India Limited has informed the Exchange about Schedule of meet

ESG Ratings By S&P Global

25-Nov-2025 | Source : BSESapphire Foods India Limited has informed the Exchange about ESG Rating by S&P Global

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Nov-2025 | Source : BSESapphire Foods India Limited has informed the Exchange about Schedule of meet

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Sapphire Foods India Ltd has announced 2:10 stock split, ex-date: 05 Sep 24

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Mutual Funds

None

Held by 22 Schemes (31.48%)

Held by 123 FIIs (31.31%)

Sapphire Foods Mauritius Limited (23.81%)

Hdfc Trustee Company Limited-hdfc Flexi Cap Fund (9.6%)

3.76%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -4.43% vs 9.21% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -609.44% vs -200.56% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.45% vs 9.02% in Sep 2024

Growth in half year ended Sep 2025 is -365.88% vs -86.40% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 10.60% vs 15.10% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -65.37% vs -48.42% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.09% vs 14.51% in Mar 2024

YoY Growth in year ended Mar 2025 is -63.55% vs -77.37% in Mar 2024