Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 4.17%

- Poor long term growth as Net Sales has grown by an annual rate of 6.40% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.20

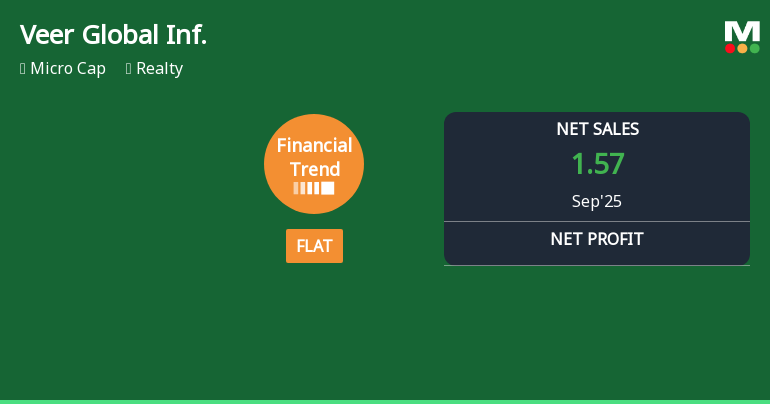

Flat results in Sep 25

With ROCE of 8.1, it has a Very Expensive valuation with a 3.9 Enterprise value to Capital Employed

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Oct-21-2022

Risk Adjusted Returns v/s

Returns Beta

News

Veer Global Infraconstruction Ltd is Rated Strong Sell

Veer Global Infraconstruction Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 19 Nov 2025, reflecting a comprehensive assessment of the company’s current standing. However, all fundamentals, returns, and financial metrics discussed here are based on the latest data as of 24 December 2025, providing investors with an up-to-date view of the stock’s performance and prospects.

Read More

Veer Global Inf. Sees Revision in Market Evaluation Amidst Challenging Realty Sector Conditions

Veer Global Inf., a microcap player in the Realty sector, has undergone a revision in its market evaluation reflecting recent shifts in its fundamental and technical outlook. This adjustment comes amid a backdrop of subdued stock performance and valuation concerns, highlighting the complexities faced by the company in a competitive and fluctuating real estate environment.

Read More

Veer Global Infraconstruction Quarterly Performance Highlights Amid Market Shifts

Veer Global Infraconstruction's recent quarterly results reveal a shift in its financial trend, moving from a previous phase of non-qualification to a flat trajectory. This change reflects evolving dynamics in revenue growth and margin performance within the realty sector, set against a backdrop of mixed market returns and sectoral challenges.

Read More Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Dec-2025 | Source : BSECompliance certificate under Reg 74(5) of SEBI (DP) Regulation 2018

Announcement Under Regulation 30 (LODR) -

08-Dec-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) - Show Cause Notice from the Office of the State Tax Officer Palghar.

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Nov-2025 | Source : BSENewspaper Publication of Standalone Unaudited Financials Results for the Quarter & Half Year ended as on September 30 2025

Corporate Actions

No Upcoming Board Meetings

Veer Global Infraconstruction Ltd has declared 2% dividend, ex-date: 21 Oct 22

No Splits history available

Veer Global Infraconstruction Ltd has announced 1:1 bonus issue, ex-date: 22 Aug 23

Veer Global Infraconstruction Ltd has announced 1:9 rights issue, ex-date: 10 Feb 23

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Vijaybhai Vagjibhai Bhanshali (19.73%)

Sunita Sanjay Gupta (2.55%)

25.46%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 31.93% vs 0.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 305.88% vs -63.83% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs -100.00% in Mar 2025

Growth in half year ended Sep 2025 is -58.09% vs 40.12% in Mar 2025

Nine Monthly Results Snapshot (Standalone) - Mar'25

YoY Growth in nine months ended Mar 2025 is -53.00% vs 141.20% in Sep 2025

YoY Growth in nine months ended Mar 2025 is 97.30% vs 20.65% in Sep 2025

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs -100.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 23.97% vs 102.78% in Mar 2024